30 August 2024

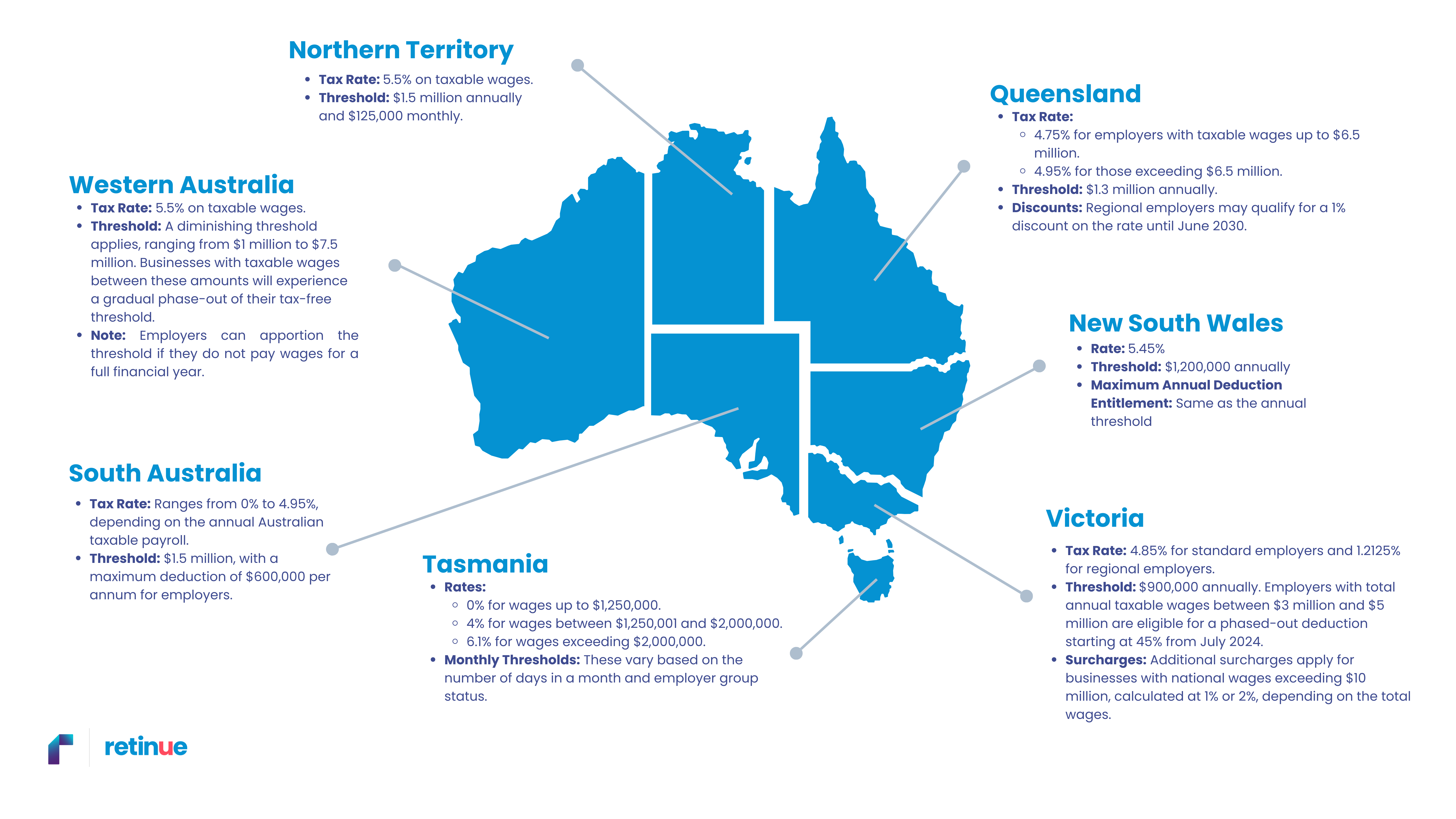

Understanding payroll tax rates and thresholds across different states and territories in Australia is crucial for small business owners. Being well-informed about these thresholds can significantly influence a business’s financial management and strategic planning. In this article, we’ll explore the payroll tax thresholds in various Australian jurisdictions and discuss their potential impact on small businesses.

Payroll tax is a state tax imposed on employers based on the total wages they pay to their employees. Typically, businesses with taxable wages above a certain threshold must register for payroll tax and pay the applicable rates. Understanding these thresholds is vital for managing tax liabilities and avoiding unexpected costs.

When a business’s taxable wages exceed payroll tax thresholds, the financial consequences can be significant. Companies must pay payroll tax on the amount that surpasses the threshold, which can strain cash flow and reduce profitability. This makes it essential for small businesses to closely monitor their total wages to avoid unexpected tax burdens.

The harmonisation of payroll tax rules across Australian states and territories is designed to simplify compliance for businesses that operate in multiple regions. This alignment covers key areas such as the timing of return lodgements, motor vehicle allowances, and accommodation allowances. By standardising these provisions, harmonisation reduces administrative complexity and makes it easier for businesses to manage payroll tax obligations across different jurisdictions.

For businesses with part-year employment or operations in multiple states, payroll tax thresholds may be subject to adjustments. Accurate calculations are crucial to ensure that businesses do not overpay or underpay their taxes.

For more information on managing your business’s payroll tax obligations, or to discuss how Retinue can assist with payroll tax requirements, call us at 1800 861 566.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.