30 October 2024

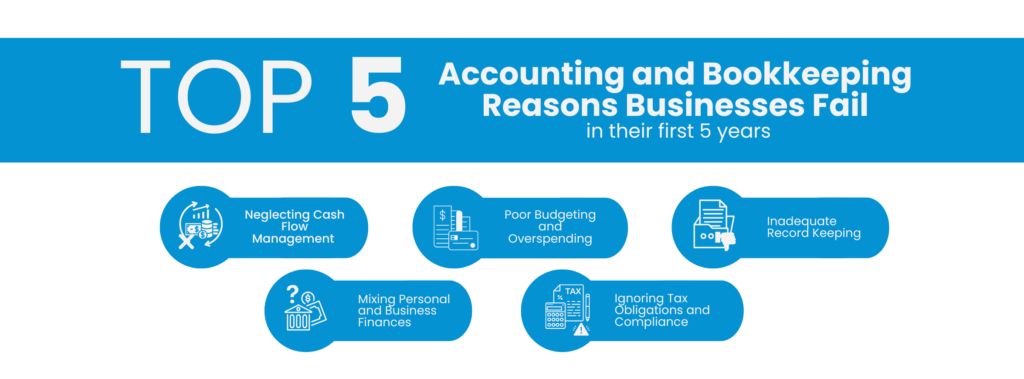

Starting a business is an exciting journey, but the road to success is paved with challenges. Research shows that around 60% of Australian businesses don’t make it past the five-year mark, with financial missteps as one of the primary reasons. Whether you’re just launching or looking to strengthen your existing business, understanding the common accounting and bookkeeping pitfalls can help you stay on track.

Here are the top five accounting and bookkeeping mistakes that can derail businesses early on—and how to avoid them.

2. Poor Budgeting and Overspending

3. Inadequate Record Keeping

4. Mixing Personal and Business Finances

5. Ignoring Tax Obligations and Compliance

Avoiding Failure with Smart Financial Practices

In the fast-paced world of business, it’s easy to focus on growth and overlook the importance of sound financial practices. But by proactively managing cash flow, sticking to a budget, keeping clear records, separating personal and business finances, and staying on top of tax obligations, you can lay a solid foundation for long-term success.

At Retinue, we understand the challenges Australian businesses face, especially in their early years. Our team offers the guidance and support to keep your financial house in order, letting you focus on building a thriving business.

Connect with us to learn how we can help you avoid these common pitfalls and set your business on the path to success. Call us on 1300 823 040 to get started.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.