14 November 2024

Taking on your own bookkeeping might sound like a great way to cut costs and stay in control of your business, but it often ends up more complicated—and risky—than you might think. DIY bookkeeping is a bit like attempting your own home renovations: it can start with high hopes but quickly lead to costly errors and overwhelming headaches. Here, we reveal the hidden risks of DIY bookkeeping and why partnering with a professional might just be the best decision for your business.

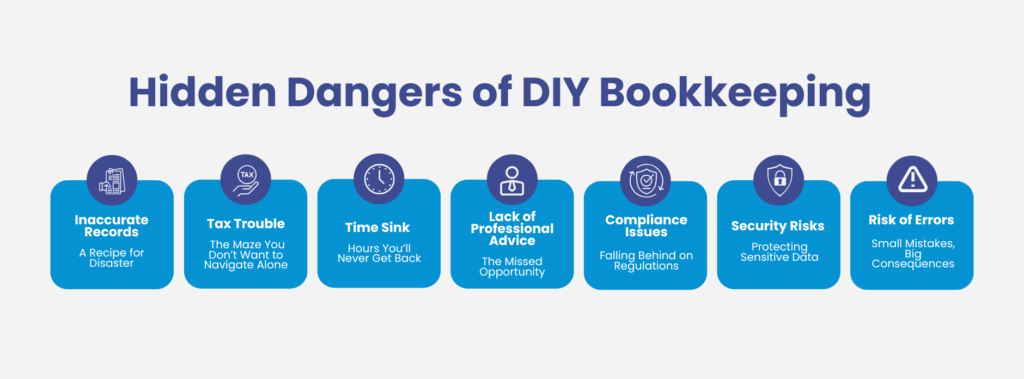

Inaccurate Records – A Recipe for Disaster

Tax Trouble – The Maze You Don’t Want to Navigate Alone

Time Sink – Hours You’ll Never Get Back

Lack of Professional Advice – The Missed Opportunity

Compliance Issues – Falling Behind on Regulations

Security Risks – Protecting Sensitive Data

Risk of Errors – Small Mistakes, Big Consequences

Why Risk It? Let Retinue Take the Pressure Off

Call Us Today

Ready to let go of the bookkeeping burden? Contact us at 1300 823 040, and let us take care of the numbers, so you don’t have to.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.