4 September 2024

Understanding payroll tax compliance is more than just a legal necessity; it’s a cornerstone of financial health for your business in Australia. Failing to comply with the distinct payroll tax rates and thresholds in each state could mean penalties and operational disruptions.

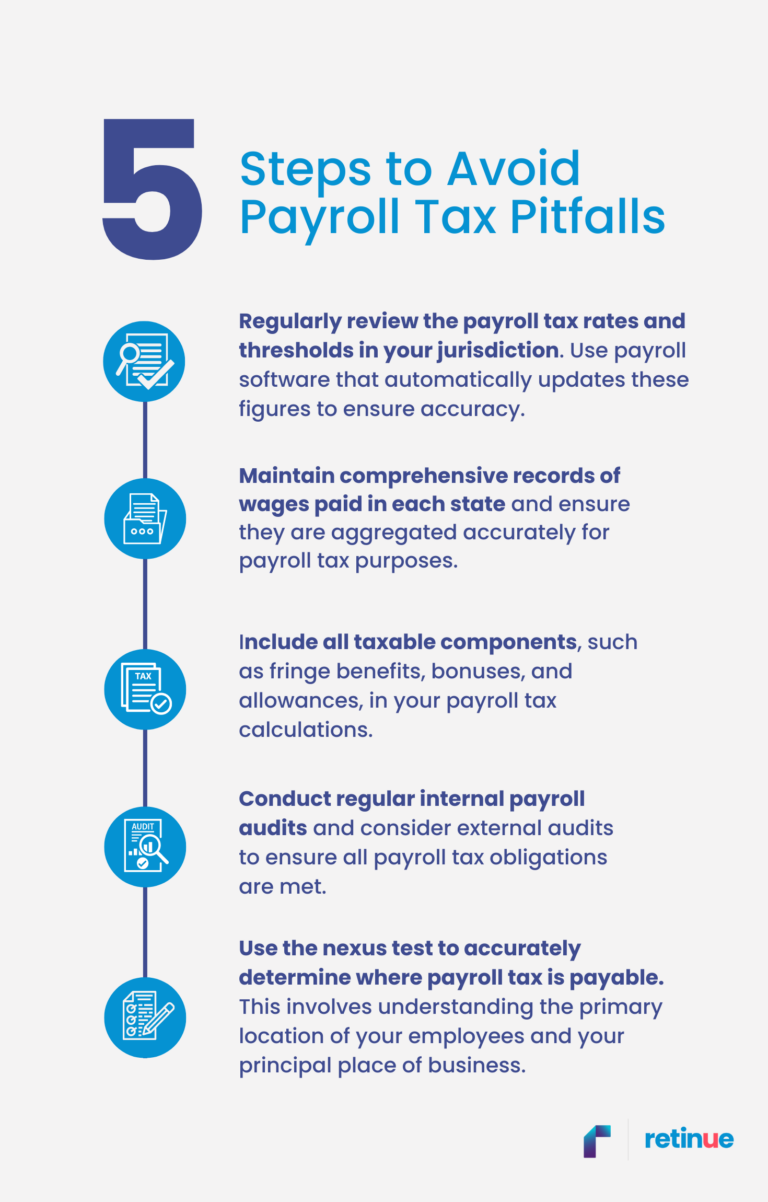

This article aims to provide business owners with practical insights into common payroll tax pitfalls and strategies to avoid them.

Payroll tax is a state-imposed tax on the total wages paid by employers to their employees. Each state and territory in Australia sets its own rates and thresholds. This makes business operations across multiple regions extra challenging. Being aware of these variations and understanding your obligations, however, is the first step towards compliance.

Another common struggle for business owners in regards to payroll tax is the classifying of employees. An employment relations expert will be able to help you overcome this challenge.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.