21 October 2024

Running a business comes with challenges, but few are as persistent and frustrating as dealing with late payments. Clients who fail to pay on time can cause significant cash flow problems, making it difficult for you to pay your bills, maintain inventory, or pay your staff on time.

There are ways to handle this issue effectively and ensure your business remains financially stable. Here are some practical strategies to help you manage late payments and maintain a healthy cash flow.

Understand the Impact of Late Payments

Late payments are a significant issue for many businesses. Delays can severely impact your ability to meet financial obligations, straining your business operations and growth.

Late payments can lead to cash flow shortages. This causes difficulty in paying wages, and rent, or even investing in new opportunities.

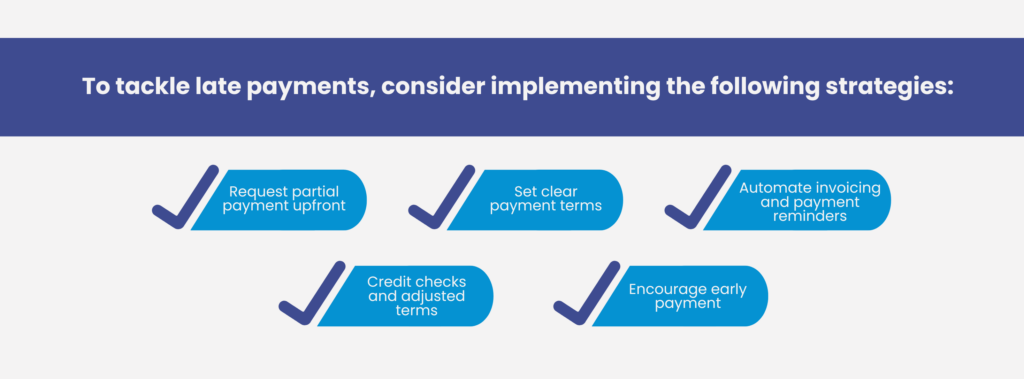

Strategies to Minimise Late Payments

Manage Relationships with Late-Paying Clients

Striking a balance between maintaining a positive relationship with your clients while addressing late payments can be tough—but it must be done. Here’s how to handle clients who frequently pay late:

Tools and Techniques to Improve Cash Flow

Aside from managing late payments, there are additional steps you can take to enhance your overall cash flow:

The Bottom Line: Stay Proactive to Protect Your Cash Flow

Late payments are common, but they don’t have to cripple your business. You can reduce the impact of late payments on your cash flow by managing payment policies proactively.

To help you manage cash flow and handle late payments, call Retinue today at 1800 861 566. We’re here to help you protect your business cash flow.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.