18 October 2024

If there’s one thing that puts small business owners under immense pressure, it’s navigating taxation—and the Fringe Benefit Tax is perhaps the trickiest obstacle in this obstacle course. But don’t worry, you’re not in this alone! Let’s walk through FBT step by step, so by the end, you’ll feel more confident in your calculations.

Let’s not state the obvious, but shouldn’t you understand what Fringe Benefit Tax (FBT) is before diving into how to calculate it? FBT is a tax employers pay on certain non-salary perks they provide to employees, like company cars, gym memberships, or even that business lunch that lasted a bit longer than you expected.

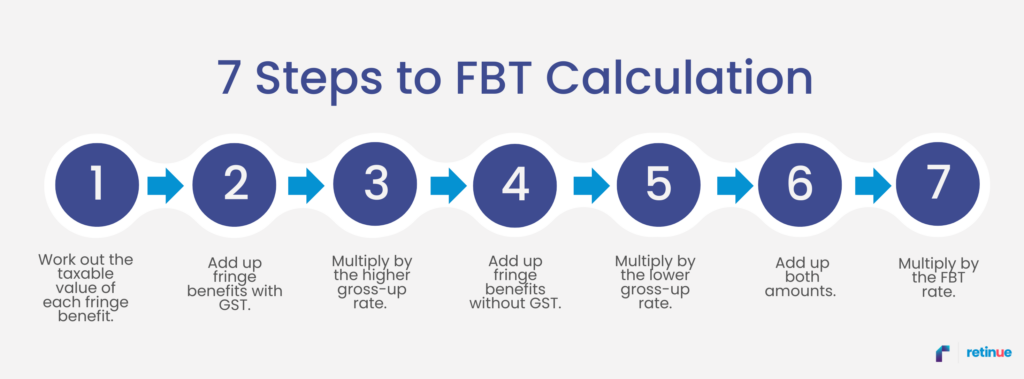

Here’s where it gets a bit tricky: FBT isn’t calculated based on the value of the benefit itself. Instead, you must ‘gross-up’ the benefit, reflecting how much your employees would need to earn to pay for it themselves. Wondering how to do that?

Make sure you’ve got a calculator handy, and maybe a cup of coffee too!

Let’s face it, FBT is one of those tricky areas of tax law where things can get complicated fast. While this guide is a great starting point, it’s always a good idea to consult a financial expert to make sure you’re getting your FBT calculations just right.

Call us at 1800 861 566, and we’ll be happy to lend a hand!

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.