17 October 2024

Buying a vehicle for your business can be an exciting step but, before you hit the dealership and start test-driving, there are a few key rules you should keep in mind. After all, a wrong decision could leave you with a vehicle that drains your finances faster than it gets you to your next meeting.

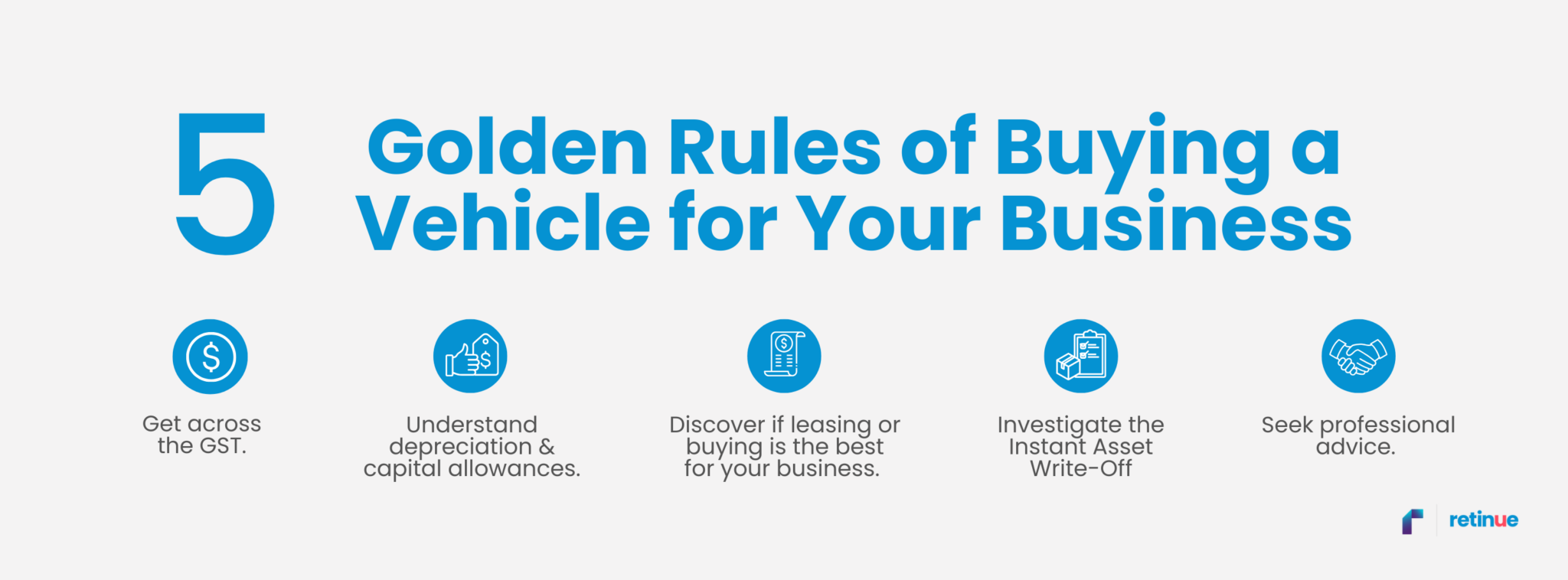

Hit the brakes and check out our five golden rules.

You know that feeling when you see a price tag and then recall there’s tax on top? The silver lining to buying a vehicle for commercial use, when your business is registered for GST, is that you might be able to claim a GST credit. That means you could reclaim the GST included in the purchase price, which softens the blow a bit. But remember, there are some conditions to this perk, so be absolutely certain that the vehicle is indeed for business use.

Now, here’s the thing: cars don’t quite appreciate in value—the moment you buy a vehicle, it starts losing its value. Fortunately, you can claim deductions for that decline. Businesses in Australia can claim capital allowances on certain assets, such as cars, to subtract the cost from their tax bills. The depreciation deductions are generally calculated based on the cost of the car, its effective life, and its business usage percentage.

Commitment or flexibility? That seems to be the big question when it comes to leasing versus buying a business vehicle. Leasing could mean lower upfront costs, but the vehicle isn’t yours at the end of the lease term. Buying gives you ownership, but it comes with higher initial costs. Each of these options also has its different tax implications and GST treatments, so you will need to choose wisely. Leasing might be a great short-term solution, but if you’re in it for the long run, buying may be the better route to take.

This handy tax break lets you instantly claim a deduction for those assets you buy, including vehicles, up to a certain threshold. Make sure you are up to date on the latest rules, because claiming this deduction can make quite a difference in your cash flow. Timing is everything—if your business needs a vehicle and the write-off is on the table, it’s a win-win!

When it comes to buying a vehicle for your business, don’t go it alone. It’s always easier when you have someone sitting next to you in the passenger seat! A qualified accountant can assist you while navigating the tricky tax terrain, make sure you’re getting the best deal and help you make informed decisions that will ease the tax burden in the long run.

Ready to hit the road in your new business vehicle?

Follow these five golden rules, and you will be smoothly cruising toward tax savings in no time. Need assistance? Give us a call at 1800 861 566—we’re here to help you steer clear of any financial roadblocks!

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.