27 September 2024

Navigating payroll tax can be a daunting task for business owners, but understanding how to calculate it accurately is essential for staying compliant and avoiding costly penalties. Payroll tax is a state-based tax levied on wages paid by an employer, and the rules can vary depending on your location and the size of your payroll.

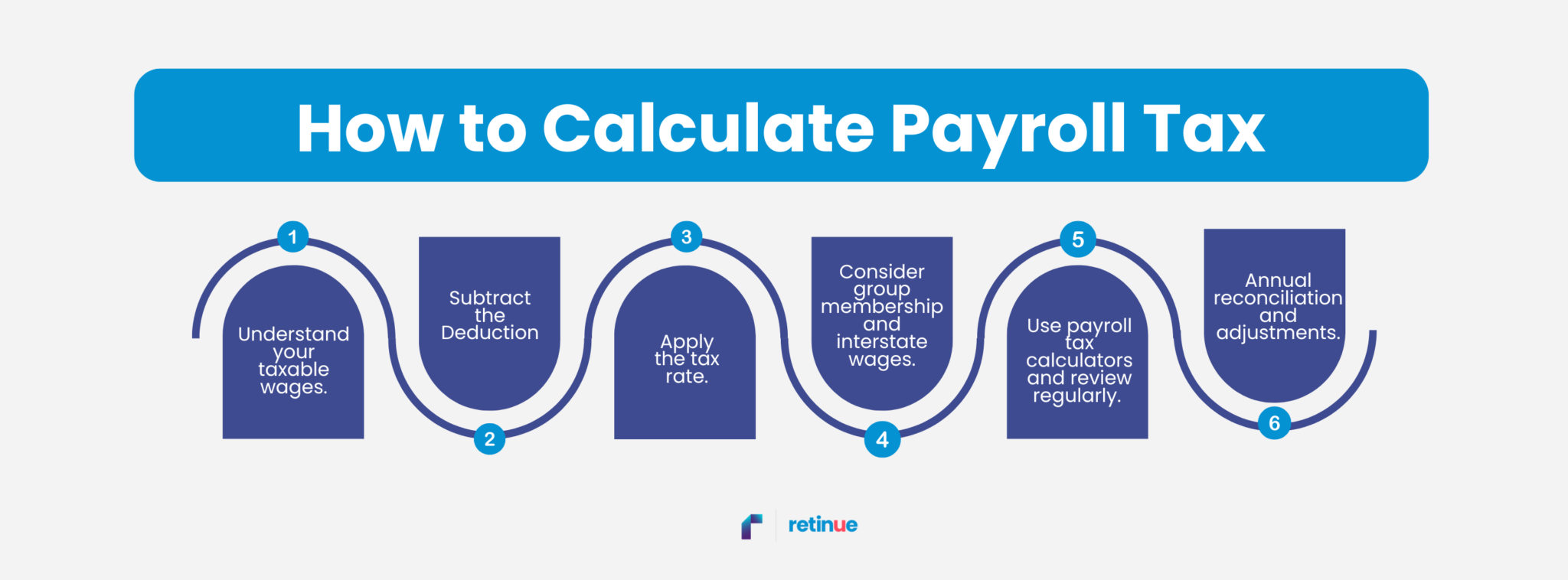

This step-by-step guide will walk you through the process of calculating payroll tax, focusing on the nuances and details that are crucial in helping you meet your obligations.

The first step in calculating payroll tax is to determine your gross taxable wages. These include all wages paid to your employees: salaries, bonuses, allowances, and certain fringe benefits. It’s important to note that each state and territory may have specific definitions and exemptions, so ensure you are familiar with the regulations applicable in your area.

Once you have your gross taxable wages, you need to apply the deduction amount to arrive at your net taxable wages. For example, in South Australia, the maximum deduction available is $600,000 per annum (up to $50,000 per month). If your business only operates for part of the financial year, this deduction will be proportionally reduced based on the number of days you employed staff in South Australia.

Example Calculation: If your annual wages are $1.6 million and you are eligible for the full $600,000 deduction:

Next, apply the relevant tax rate to your net taxable wages. Tax rates vary between states and may change annually. Check out our article on this: State-by-State Payroll Tax Comparison: Where Does Your Business Stand?

Here is a sample computation as of the latest rates:

Example Calculation: For a South Australian business with $1,000,000 net taxable wages:

If your business is part of a group or operates across multiple states, the calculation becomes more complex. The payroll tax rate will be based on the total Australian wages of the group. Only the designated group employer (DGE) can claim the deduction on behalf of the group, and any unused deduction can be distributed among group members during the annual reconciliation.

To ensure accuracy, use available payroll tax calculators provided by state revenue offices. These tools can help estimate your payroll tax liability based on your projected annual wages. Regularly review your payroll tax calculations, especially if there are changes in your wage structure or group membership during the year.

Example Calculation Using a Payroll Tax Calculator:

At the end of the financial year, you must reconcile your payroll tax payments. The estimated payroll tax rate used throughout the year will be compared to the actual rate based on your final wage figures. Any discrepancies will be addressed during this reconciliation process, with overpayments refunded and underpayments required to be settled.

Payroll tax compliance can be complex, especially for businesses with employees across multiple states. Engaging a professional payroll provider or consulting with an experienced accountant can help ensure that your payroll tax calculations are accurate and that you maximise any available deductions.

For guidance on payroll tax, contact Retinue at 1800 861 566. Our team is here to help you navigate the complexities of payroll tax and optimise your business’s financial strategy.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.