13 September 2024

Cash flow is like fuel for a car. Without a steady fuel supply, the car can’t move forward or reach its destination. Likewise, a business needs a continuous cash inflow to drive its operations, pay its bills, and move toward its goals.

Without a clear understanding of where your money is going and when it’s coming in, you risk running into cash flow problems. This can disrupt operations or worse, jeopardise the viability of your business.

Thankfully, creating a cash flow forecast doesn’t require some magic trick—just some practical steps and a little strategic thinking. Let’s walk through how you can develop a cash flow forecast for your business to stay ahead of financial challenges and seize growth opportunities.

A cash flow forecast is a financial tool that helps you predict your business’s cash flow over a specific period. It provides a snapshot of your business liquidity by comparing your expected inflows (like sales or investments) and outflows (like bills or salaries) to calculate your net cash flow for the period. This tool is essential for short-term and long-term planning, allowing you to anticipate potential cash shortfalls and take pre-emptive action.

Understanding your cash flow is vital for maintaining the health of your business. A well-prepared forecast helps you:

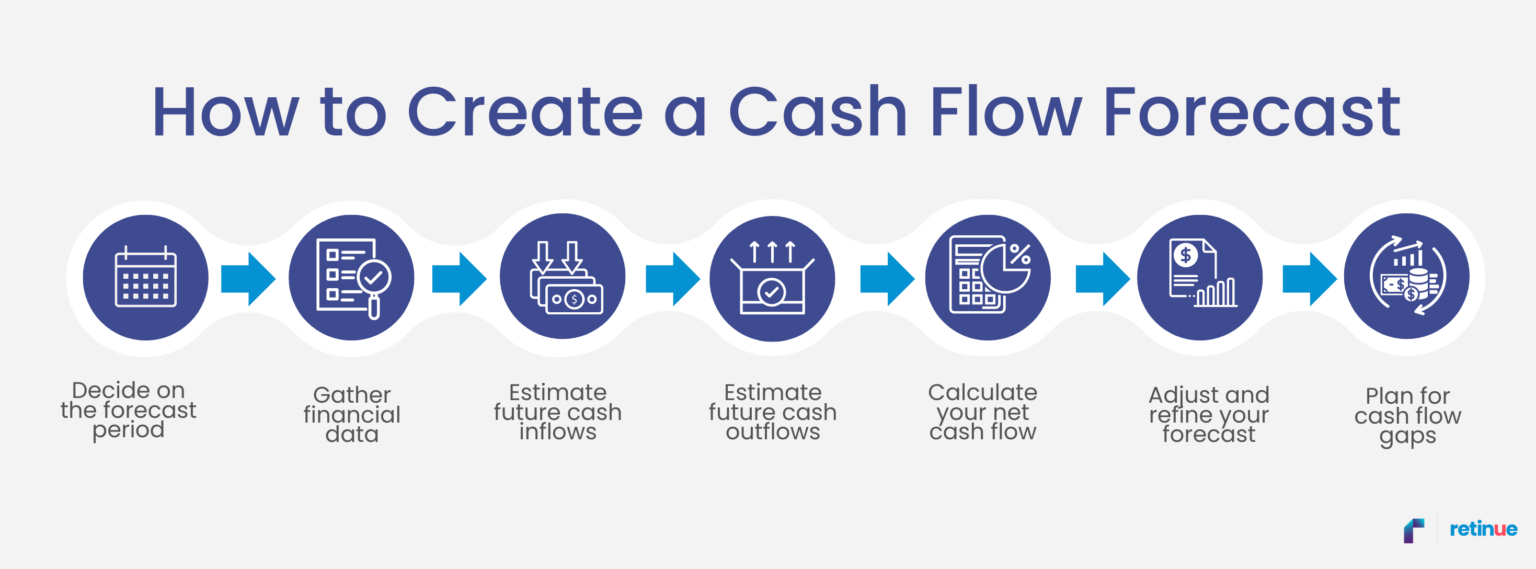

Creating a cash flow forecast involves a few essential steps. Here’s a straightforward guide to help you get started:

1. Decide on the Forecast Period

The first step is to decide on the period you want your forecast to cover. Common timeframes include weekly, monthly, or quarterly forecasts, depending on your business needs. For example, a weekly forecast may suit businesses with frequent transactions, while a monthly or quarterly forecast may suffice for those with more predictable cash flow.

2. Gather Financial Data

Start by collecting data on your current cash position, including:

Using your accounting software or tools like Excel, you can organise this data to make tracking easier. Many businesses also use specialised accounting software like MYOB to streamline the process.

3. Estimate Future Cash Inflows

To predict cash inflows, review your sales history and any upcoming payments. Consider all sources of income, including:

Be realistic with your estimates to avoid overly optimistic projections that could lead to cash flow problems later.

4. Estimate Future Cash Outflows

Next, outline your expected cash outflows. Include all regular expenses such as:

For variable expenses, consider the historical data and any anticipated changes. Make sure to account for unexpected costs to avoid being caught off guard.

5. Calculate Your Net Cash Flow

After listing all your inflows and outflows, subtract the total outflows from total inflows to determine your net cash flow for the period. This calculation will show whether you expect a surplus or deficit during the forecast period.

A positive net cash flow indicates that you have more money coming in than going out, providing a cushion for unexpected expenses or investments. A negative net cash flow, on the other hand, signals a potential shortfall that needs addressing.

6. Adjust and Refine Your Forecast

Cash flow forecasts are not static. Regularly update your forecast with actual data to improve accuracy over time. Review past forecasts to see where your estimates were off and adjust your approach accordingly. Ask yourself:

Regular refinements will help you create more reliable forecasts and give you a clearer picture of your business’s financial future.

7. Plan for Cash Flow Gaps

If you forecast a cash flow gap (a period where outflows exceed inflows), consider strategies like:

For instance, a business overdraft facility could provide flexible access to funds when needed, or invoice financing can unlock cash tied up in unpaid invoices.

Bonus: Free Financial Foundations Toolkit

To further aid in managing your cash flow, download our Free Financial Foundations Toolkit. This toolkit inclides templates to help you build a robust financial foundation for your business.

Creating a cash flow forecast is not just about predicting the future; it’s about preparing for it. Don’t leave your success to chance—download our free toolkit today.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.