2 September 2024

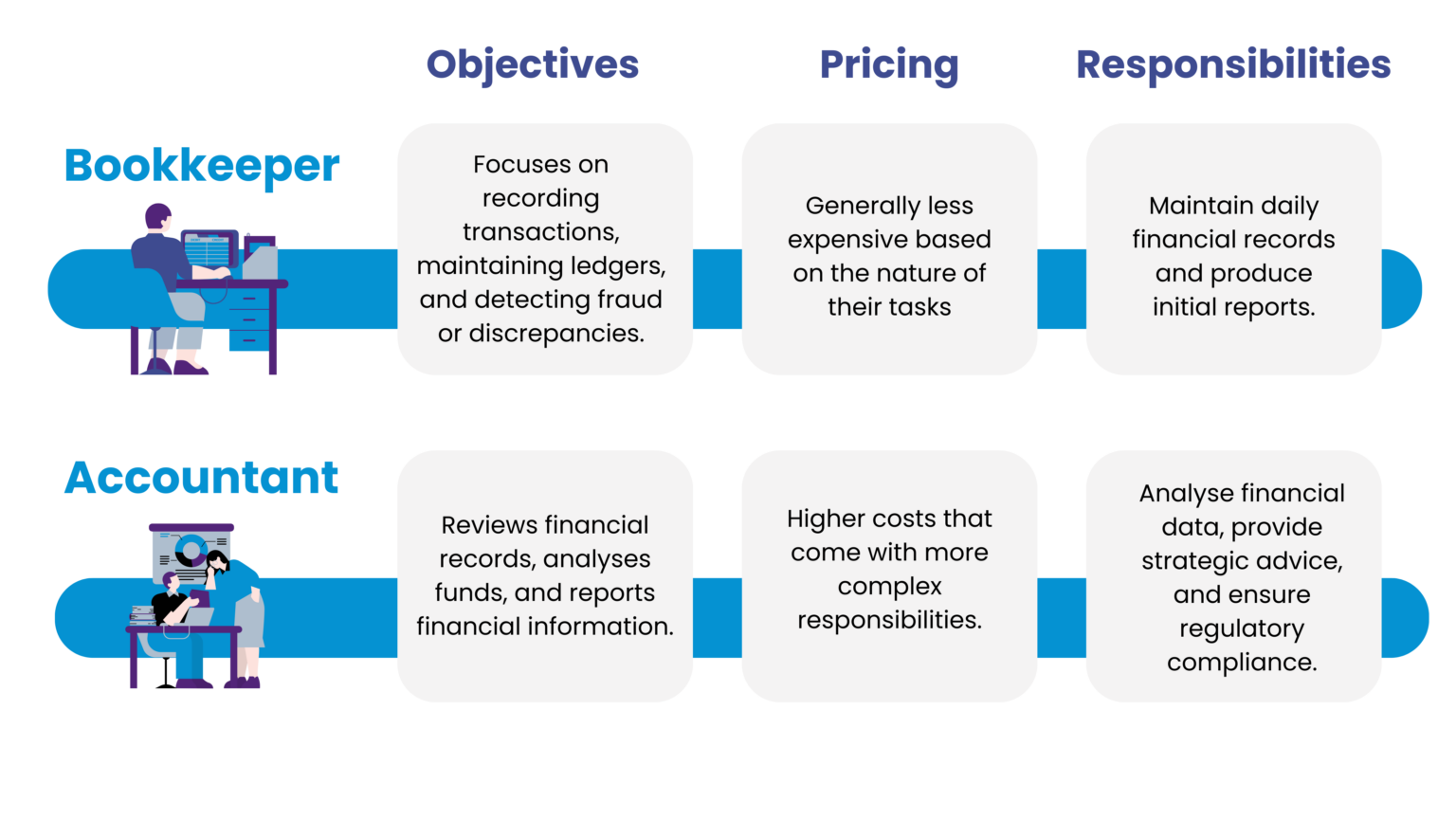

In business, when you talk about money and finances, two roles come to mind: bookkeeping and accounting. Though the terms are often used interchangeably, they encompass distinct functions for managing your business’s finances. Understanding these differences can help you make informed decisions about what your business needs. Let’s delve into what sets bookkeeping and accounting apart and why both are crucial for managing your small business finances.

Bookkeeping is the process of recording all financial transactions a business makes. This practice helps establish the company’s financial outcomes and allows owners to track where their money is going.

Bookkeepers document transactions such as:

Bookkeeping has two main methods: single-entry and double-entry. Single-entry bookkeeping tracks the basics of a company’s spending and earnings, while double-entry bookkeeping tracks additional transactions such as assets, liabilities, and overall company financial health. Regardless of the type of bookkeeping a company chooses, recording the day-to-day business financial transactions is an integral part of accounting.

A bookkeeper keeps track of day-to-day business finances, recording transactions and managing general ledgers. Good bookkeepers are organised, skilled with numbers, and natural problem-solvers.

Common bookkeeper responsibilities include:

While accounting involves documenting business financial transactions, it goes further into summarising, analysing, and interpreting financial data. Accounting reports these findings to tax collectors and regulators. They are essentially the financial storyteller of your business; this covers the business’s profitability or losses.

Bookkeeping lays the groundwork of small business accounting. Since accountants use the information gathered by bookkeepers to prepare larger financial statements and reports, the accounting process wouldn’t be possible without the help of bookkeepers.

Accountants use bookkeeping records to assess big-picture finances and make informed business decisions. They also provide insights about the company’s overall financial health to business owners and other stakeholders.

Common accountant responsibilities include:

Deciding whether to hire a bookkeeper or an accountant depends on your business needs. Many businesses benefit from working with both. Their combined skills to handle daily tasks and strategic decisions are both crucial.

At Retinue, we understand the importance of both bookkeeping and accounting in maintaining a healthy business. Our team of skilled professionals can help you stay on top of your small business’s finances. Call us today at 1800 861 566 to learn more.

*Retinue’s (ABN 66 658 618 449) payroll service includes the processing of hours and wages rates provided by you. We do not determine award rates for your employees or provide advice on the correct employment status of your employees. It is your responsibility to ensure that your employees are paid correctly and we recommend obtaining advice from specialised employment relations experts.

Protection is only provided for ATO investigations notified to us during the period which you are a client and relating to any tax returns or lodgements prepared by us. Fines includes any penalties and interest that may result from any errors made by us but does not include any additional tax liability that may result from an amended lodgement.

Liability limited by a scheme approved under Professional Standards Legislation.

©2024 Retinue. All rights.